Taxpayers are allowed to deduct qualified medical expenses on schedule A of a personal tax return. These expenses are subject to a 10% adjusted gross income floor (7.5 percent if you are over age 65). For example, if you have adjusted gross income of $50,000 you would be unable to deduct the first $5,000 in qualified medical expenses. Qualified medical …

Itemized Deduction: Charitable Contributions

In order for charitable contributions to be deductible, the organization must be a nonprofit organization approved by the IRS. There is a database of approved nonprofit organizations available on www.irs.gov . Charitable contributions are not subject to an adjusted gross income floor. This means that if you are eligible to itemize, you may be able to deduct 100% of your …

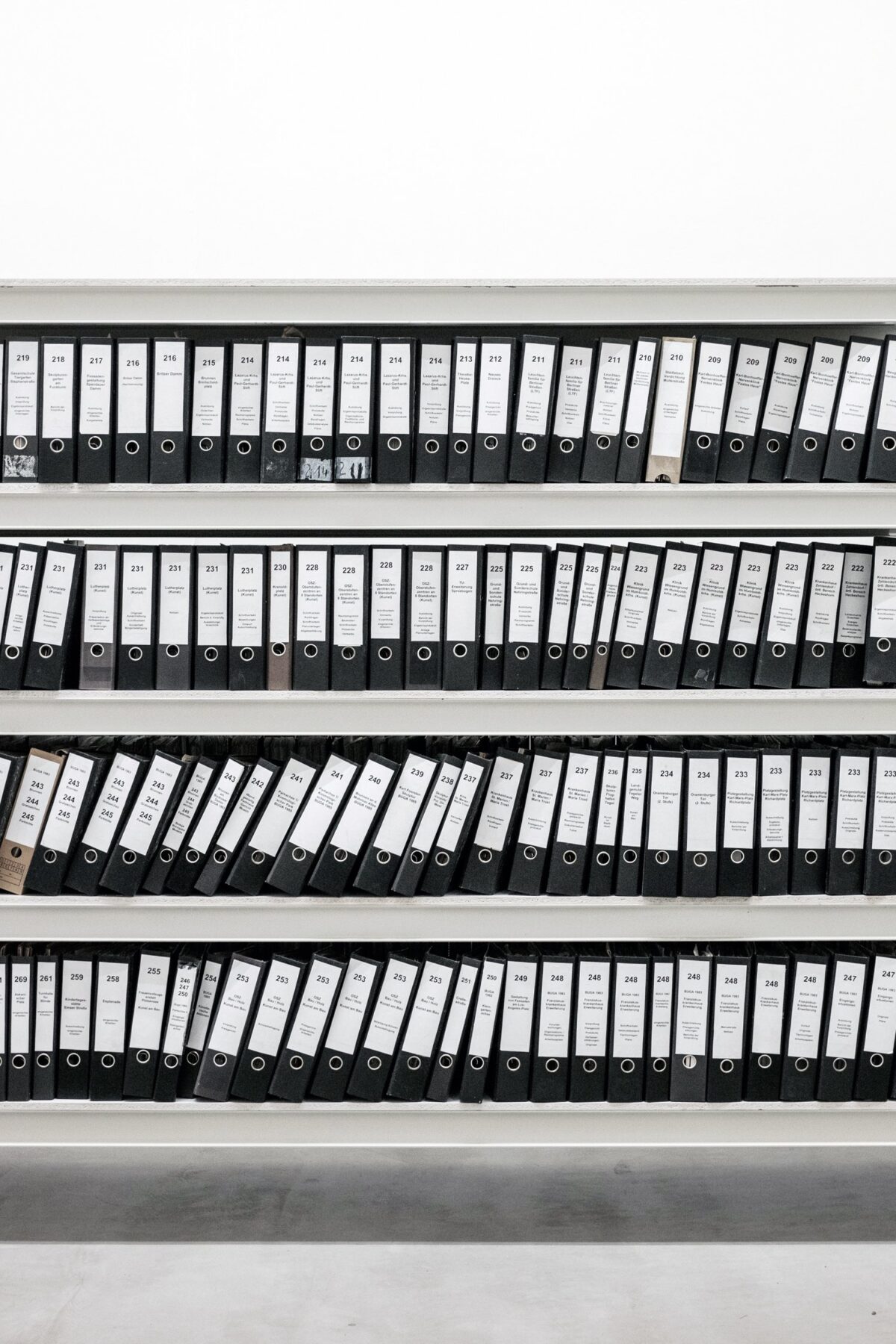

How Long Do I Keep My Tax Records?

The conservative approach, and our recommendation, is to keep your tax documents for seven years. The rule of thumb is to add a year to the statute of limitations period. This period three years, but changes with certain circumstances. If you under-reported gross income by 25% or more on your tax return, the statute of limitations increases to six years. …

Earned Income Tax Credit

The earned income tax credit is available to working Americans with low incomes. It is designed to keep families out of poverty, while still encouraging taxpayers to work. According to the Internal Revenue Service, in 2010 the EITC was credited with keeping 6.6 million Americans above the poverty line, which is more than any other US anti-poverty program. The credit …