The conservative approach, and our recommendation, is to keep your tax documents for seven years. The rule of thumb is to add a year to the statute of limitations period. This period three years, but changes with certain circumstances. If you under-reported gross income by 25% or more on your tax return, the statute of limitations increases to six years. If you never file a tax return or commit tax fraud, there is no statute of limitations.

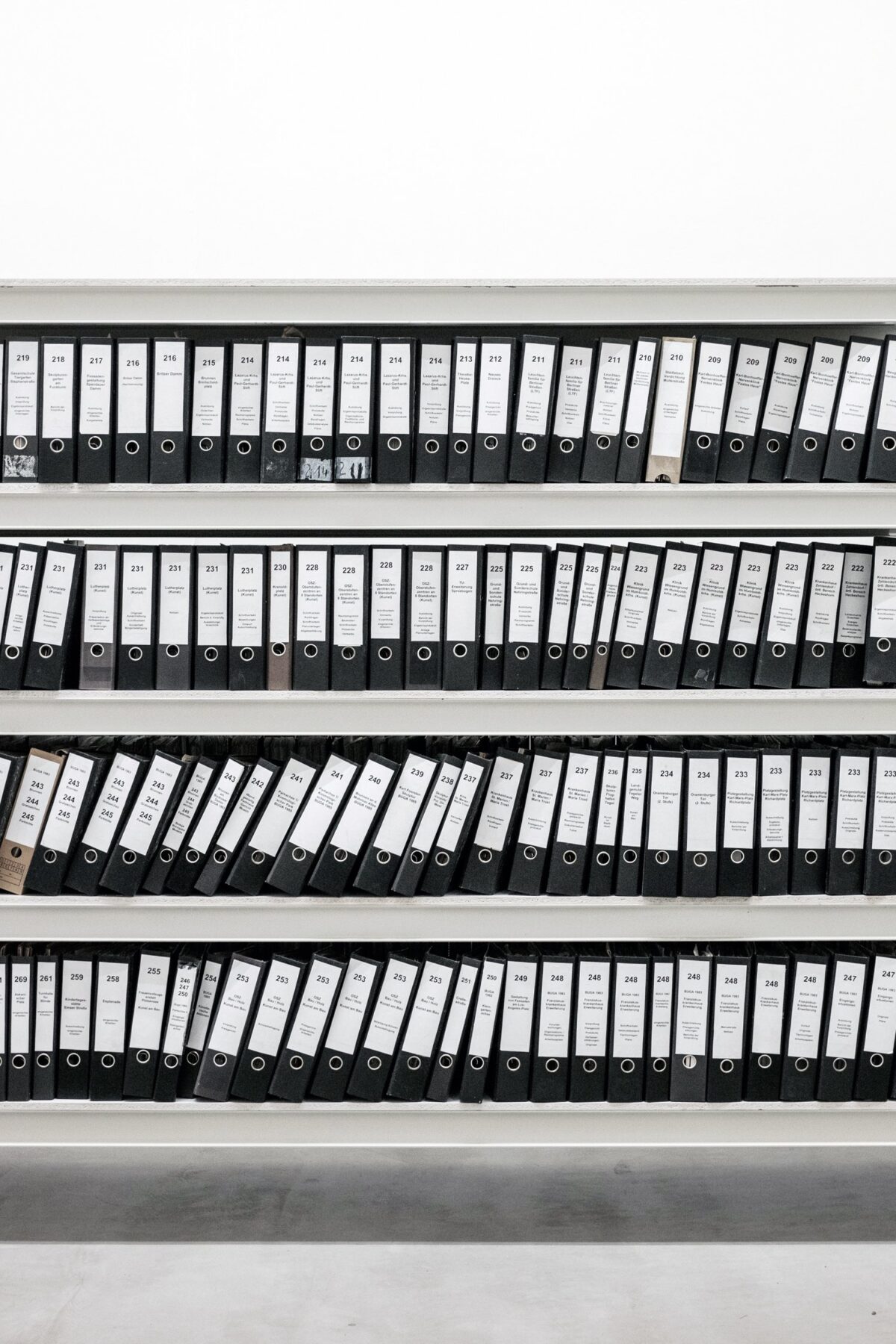

What tax documentation do I need to keep?

Documentation for deductions or business expenses, copies of your tax returns, W-2s, 1099s, and any other documentation necessary to prepare your tax return.

Proving deductions to the IRS is a two-step process. First, you must prove that you actually paid the deduction with a canceled check, bank statements, or credit card statements. Second, you must prove the expense is actually tax deductible with a receipt, bill, or invoice.

Here are some additional tips:

For certain meals and entertainment expenses, it is best practice to keep a summary of the person(s) and the business you conducted while incurring this expense. If you deduct business mileage, the IRS requires a written log of where you drove, why you drove there, and the date you made the trip.