Taxpayers are allowed to deduct qualified medical expenses on schedule A of a personal tax return. These expenses are subject to a 10% adjusted gross income floor (7.5 percent if you are over age 65). For example, if you have adjusted gross income of $50,000 you would be unable to deduct the first $5,000 in qualified medical expenses. Qualified medical …

Itemized Deduction: Charitable Contributions

In order for charitable contributions to be deductible, the organization must be a nonprofit organization approved by the IRS. There is a database of approved nonprofit organizations available on www.irs.gov . Charitable contributions are not subject to an adjusted gross income floor. This means that if you are eligible to itemize, you may be able to deduct 100% of your …

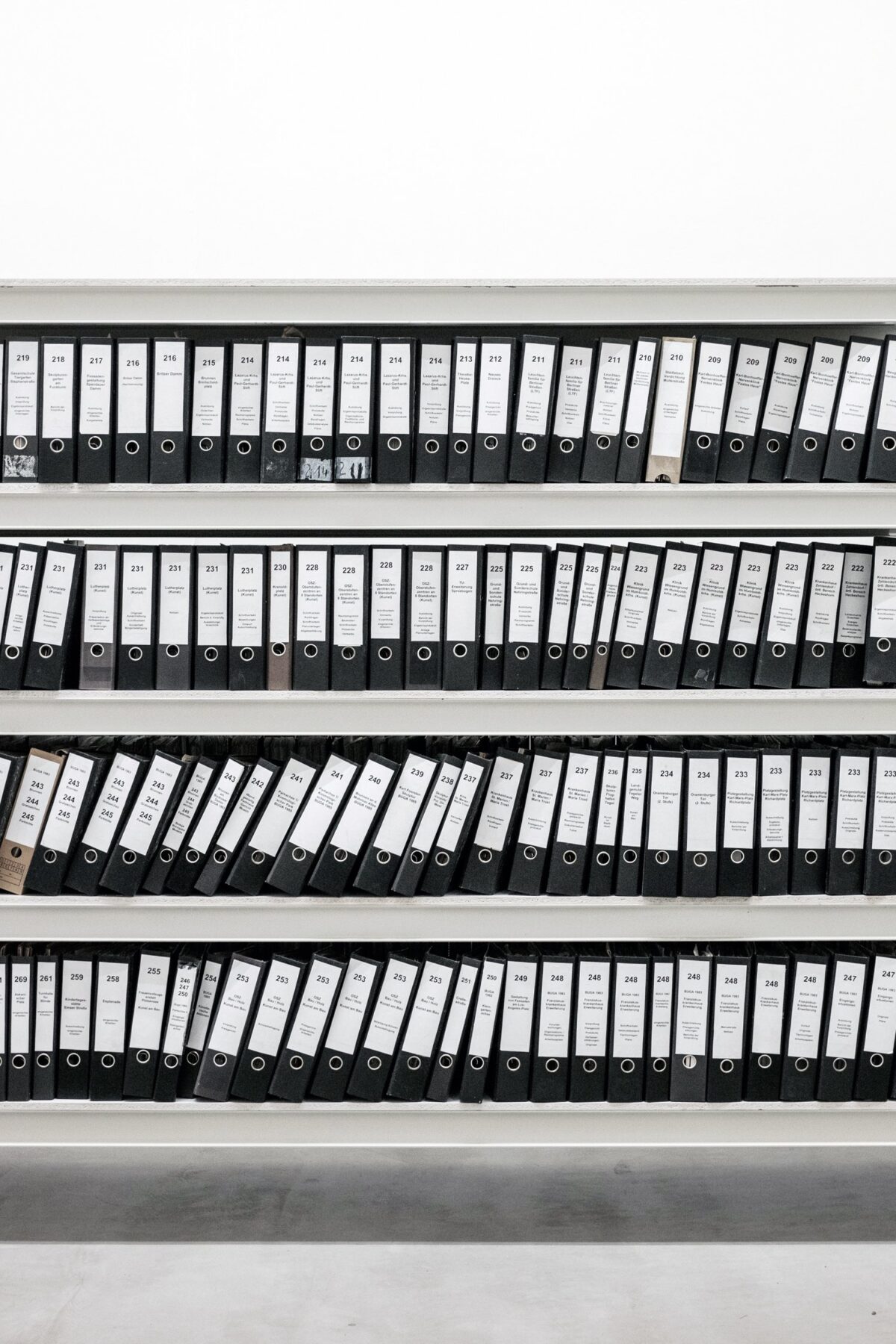

How Long Do I Keep My Tax Records?

The conservative approach, and our recommendation, is to keep your tax documents for seven years. The rule of thumb is to add a year to the statute of limitations period. This period three years, but changes with certain circumstances. If you under-reported gross income by 25% or more on your tax return, the statute of limitations increases to six years. …